Is the end of credit card hacking/churning nearing?

Hey friends,

So recently, it feels like almost every credit card has been getting hit with negative updates:

Citi Prestige Card removing the unlimited Priority Pass benefit

Annual fee increase from $79 to $149 for the Velocity Flyer Card

Exclusion period for new card sign-up bonuses doubling from 12 to 24 months for ANZ and Westpac, St George and the other banks that fall under the Westpac umbrella.

Now, changes like these are nothing new in the world of credit cards and frequent flyer programs.

But when all these updates and devaluations happen in such a short period of time, it can seem like the value that we were once getting is getting squeezed and that our options are now more limited than ever.

I think the golden days of when you could sign-up for one credit card, meet the sign-up bonus, cancel that credit card and then sign-up for another card immediately are almost gone.

Instead of signing up for multiple credit cards each year, I think it’s better to be more strategic now and wait for either upsized sign-up bonuses or special offers that give you more value e.g.

American Express runs upsized sign-up bonuses once or twice a year

Velocity runs promotion twice a year for an extra 30,000 reward points

We also need to ensure we keep track of the credit cards that we sign-up for and more importantly when we close them.

This is so that we know exactly when we are eligible to sign-up for a credit card with that provider again in order to take advantage of another sign-up bonus.

Whilst 18-24 months seems like a long time between each provider, you’d be surprised at just how quickly time can pass. If you hop around between providers a few times a year, before you know it you’ll be able to sign-up for the same provider again.

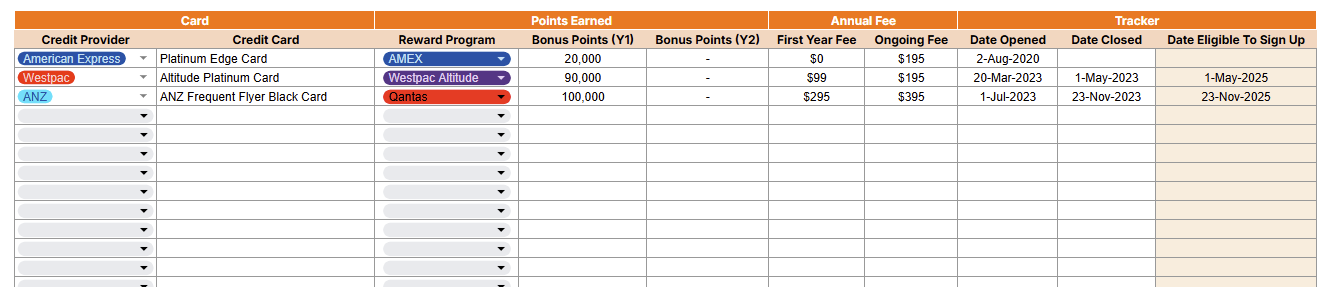

That’s why I’ve created a free credit card tracker to help you guys know exactly when you're eligible for another sign-up bonus.

👉 The credit card tracker logs - Try it out here

Sign-up/closure dates

Points earned

Fees paid

Automatically lets you know when you are eligible to sign-up again based on each bank’s exclusion periods rules

Let me know if there’s any feedback/updates you’d like to see in the tracker that I can incorporate. I created this for an upcoming video, but thought I’d share it with you all first!

💳 Credit Card Deal Of The Week

Westpac Qantas Altitude Black Card - Get up to 120,000 bonus Qantas Points and also $0 Fee 1st Year (QFF Fee $75) for existing Westpac Customers

After the first year, the Card Fee reverts to $295 thereafter

Note - Existing Westpac customers who currently hold an Earth Classic, Earth Platinum, Earth Platinum Plus, Earth Black, Altitude Classic, Altitude Platinum or Altitude Black credit card, or who have held one in the last 24 months, are not eligible for this offer.

Note - Any credit card offers and promotions I share are not affiliate links, and I am not associated with the credit providers in any way.

🎬 My Recent Video

In this video I talk through what I’d do if I started investing again in 2025.

💸 My Favourite Investing/Finance Apps That I Use

These are all the investing/finance apps that I use on a day-to-day basis.

Moomoo - Get 10 free stocks worth up to $3,000 and free brokerage for new users

Sharesight - Save 4 months when you upgrade to an annual premium plan

UBank - 4.6% p.a. high-interest savings account. Earn $30 when using code Y1CT9P2

ING - 5.0% p.a. high-interest savings account. Earn $125 when using code Jbn574

Note - The above finance apps are affiliate links and I will earn a commission, however, it comes at no additional cost to you and helps support me as a creator.