Hey friends,

Some of the most common comments or questions that are asked whenever I post a video regarding credit card hacking is

“how does credit card hacking impact your credit score?”

“your credit score must be terrible from opening and closing so many cards!”

How credit scores work in Australia is different from how it works in other parts of the world. So let’s explore this topic further in this week’s newsletter!

📈 Impact On Your Credit Score

So hard inquiries which are also known as ‘hard pulls’ occur when a lender looks into your credit score when deciding whether or not they will approve you for your application.

Each hard pull that you make will decrease your credit score pretty much immediately and I’ll show you an example

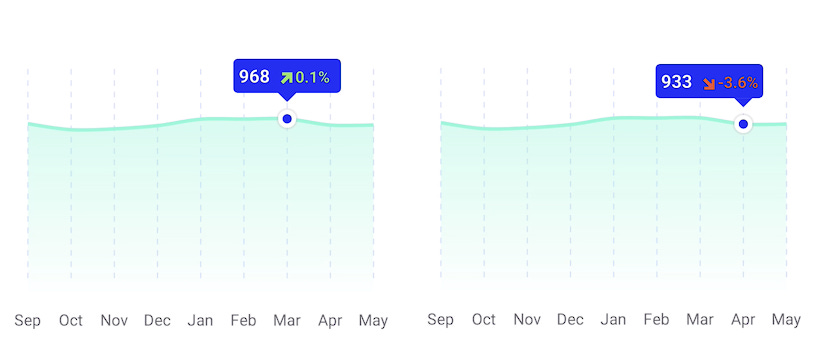

Now if we look into my credit score in the images below you’ll notice that my credit score decreased in April from 968 to 933. This coincided with me applying for a new credit card, so this confirms that each time you open up a new credit card, it will negatively impact your credit score.

(These images are from the WeMoney app which pulls data directly from Experian and Equifax to give you a view of your credit score)

So does this mean that we shouldn’t open as many credit cards? Well not exactly, you’ll see another two images below comparing my credit score back in October to January.

The decrease in October coincided with me opening another credit card, after which it took around 3 months for my credit score to increase back to where it was originally.

So whilst opening new credit cards definitely negatively impacts your credit score, it only takes around 2-3 months for it to recover to where it was originally.

So if you want to be cautious with credit card hacking, my advice would be to wait 2-3 months between each credit card that you open.

But in saying this, I’ve opened new credit cards in shorter time frames and have been fine so far. So it’s really up to your own personal preference as to how aggressive you want to be.

🏡 The impact of your credit score on your home loan

Now I’m not a mortgage broker, nor do I work for a bank so these are just my observations and what I’ve heard from other people.

But generally, your credit score doesn’t have much of an impact on getting approved for a home loan or your pre-approval amount.

The main factor that banks are looking for about home loans is your serviceability on the debt. Now every lender has different methods for calculating how much you can safely borrow, but one important calculation is your DTI which is known as your debt-to-income ratio.

Your DTI is calculated by dividing your total debts by your annual income. Lenders will look at your DTI ratio as a way to determine your serviceability that is, your ability to make mortgage repayments without falling into a tough financial position.

When assessing how much a bank will lend you, they will take into consideration any credit cards that you have open. Which is why it’s a good idea to close down all of your credit cards prior to seeking pre-approvals from a bank, if you’re looking to maximise the amount you can borrow.

💳 Credit Card Deal Of The Week

There’s a great credit card deal that popped up this week with a $0 annual fee from St George this week:

St George Rewards Platinum Card

100k Amplify Rewards Points after spending $3K within 90 days

Can be converted to 50k Velocity points

1st year annual fee is $49

But if you’re an existing customer this is waived!

Tip - if you’re not an existing customer just sign up to an Everyday Account

Complimentary International travel insurance and purchase protection cover

1 reward point for every dollar spent

Eligibility - This card is part of the same program that BankSA and Bank of Melbourne utilise. Therefore, if you have held a St. George, BankSA or Bank of Melbourne card in the last 12 months than you are not eligible for the bonus on this card.

I opened the St George Rewards Signature earlier in the year, so unfortunately I’m not eligible for this card, but I will sign my partner up for this card!

🎬 My Recent Videos

How To Pick The Right ETFS - If you’re looking to invest into ETFs for the first time, these are some things that you need to consider when doing your research!

How I Paid $700 For Qatar Q-Suites (and how you can too!) - I walk through how you can leverage points to book business class seats across multiple different airlines!

What's In My Wallet (2H 2024) - I talk through what card’s I’ve opened and closed over the year so far and the points I’ve accumulated.

Ditto on credit scores. I had no credit history when I started churning. It's increased slightly since I started, but does dip every time I open a new one.

Also currently churning the St George 100k Amplify points card (through Bank of Melbourne). It's fantastic to have that first year fee waived. Much less stressful - I don't have to worry about losing money if I miss the spend criteria.

One find this month was this spreadsheet showing the value of credit cards in gift cards: https://www.ozbargain.com.au/node/861989. People usually say it's terrible value to redeem for gift cards, but in some cases I found it's better value than redeeming for short-haul economy flights.