A re-introduction of Raymond - aiming for financial independence 💸 & credit card points nerd 🤓

Hello friends,

Hope you’ve been well this week!

I was doing some reflecting over the weekend and realised that it’s been nearly a year since I started this newsletter. But I realised that I had never actually formally introduced myself here. So I wanted to touch base with a re-introduction in this week’s newsletter!

But before that, I want to thank all of my viewers on YouTube who have been supporting me over the past 3 years on my journey and to any readers here who’ve been tuning in to my weekly newsletters. It’s wild to me that others have been able to learn from me from the videos or newsletters that I publish.

Anyway, let’s get into the introduction…

My name is Raymond, but my friends call me Ray! I’ve been creating content surrounding personal finance and credit cards since around 2021. What started as a hobby during COVID has now turned into a pretty serious side hustle which I work on after my normal 9-5.

A little bit of an overview of myself:

🧑 Age: 31

💻 Occupation: Consultant

📷 Hobbies: Travelling, eating, photography, and weightlifting

💰 Investments: ETFs, Stocks, Superannuation and a tiny bit of crypto

Why did I start creating content?

Growing up I never really had a creative outlet, while other kids did arts and crafts for subjects, my parents had me focusing on maths and science. In high school, I studied what was called the ‘Asian Five’ which included:

English

Maths Methods

Specialist Maths

Chemistry

Physics

Language (Mandarin)

Essentially it was all the subjects that scaled well… so I never really got to do anything creative during my teenage years 😂

I started exploring my creative side with photography in my mid-twenties. I bought a second-hand Sony camera and away I went. I thoroughly enjoyed the process of capturing moments and then editing the photos afterward, which is something I still do to this day whenever I travel.

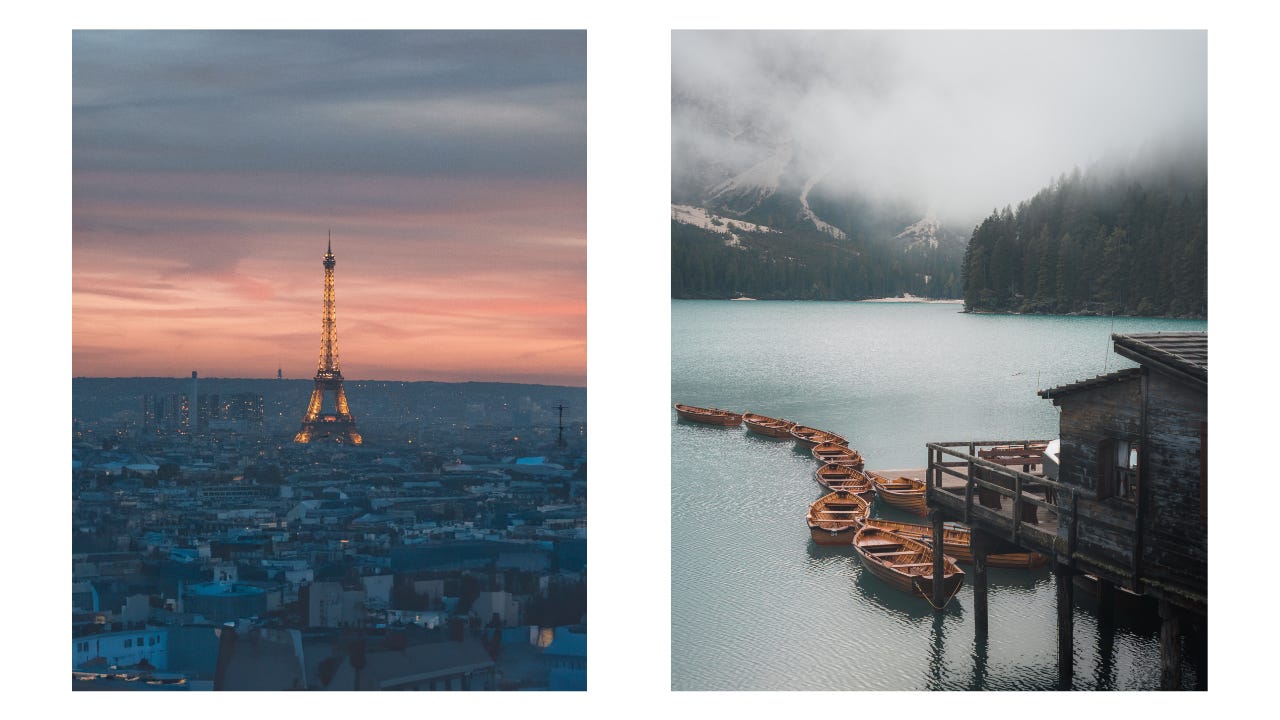

(these are a few photos I took whilst traveling in Paris and Italy last year)

Eventually, this creative outlet evolved into my decision to start creating on YouTube during the COVID-19 lockdowns in Melbourne since I had so much free time. Doing YouTube was always something I had wanted to try, but had always put it off for one reason or another.

Filming and editing videos were significantly harder than photography, but I’ve enjoyed learning all facets of the process, from script writing to filming, and video editing.

I’ve hidden a lot of my earlier videos on YouTube now because they’re extremely embarrassing, but I’ve come a long way from the beginning. 😂

Why create content about personal finance?

My family were first-generation immigrants, so we didn’t grow up with a lot of money. My father worked three jobs growing up; to this day, he still works two jobs whilst almost at retirement.

I was always pretty good at saving money because my parents instilled the importance of saving money into me growing up.

And I think it was around 2015, or 2016 when I had saved up quite a bit of money but it was just sitting there in my Commbank Goal Saver account earning like 1% interest and I knew I could be doing something with it…

I started doing heaps of research into investing through places like r/ausfinance and blogs like Mr Money Moustache. I was leaning towards investing in ETFs, but at the same time, I was also exploring purchasing an investment property.

I had gotten as far as getting a pre-approval through a mortgage broker and started attending auctions, but kept getting outbid. 😢

Ultimately, one thing led to another and I decided to put a pause on purchasing an investment property at the time because I was also contemplating moving overseas to the UK to work. So I ended up going down the route of investing in the stock market via ETFs.

And you could say the rest was history?

Since then I’ve been consistently investing for the past 8 years now. Whilst I’m not sure how things would’ve turned out differently had I purchased an investment property instead, I’m not mad with the results I’ve achieved to date.

When I started on my investing journey it took me a lot of research to figure out what investing was, the different types of investments, what I should be investing in, and how to invest.

My goal for YouTube was to always create content that I wish I had access to 8 years ago when I was doing research. Hopefully, I can help others who are just starting and need some guidance about investing.

Okay but what about credit cards?

I began dipping my toes into the world of credit cards and credit card churning once I began my first full-time job. I had stumbled upon people talking about how you could travel for free with points, and you could say I was immediately hooked.

It was almost like a video game to me, accumulating points and then redeeming them for rewards! 🎮

Once again I learned all about credit cards from various different sources online, but also from a lot of trial and error from doing it myself over the years. And so I wanted to share everything that I had learned along the way with my audience as well.

Okay to expect from my newsletter moving forward?

✍️ Content: The newsletter will still contain updates about the best credit card offers and frequent flyer updates, but I’ll also be incorporating more learnings and bite sized educational pieces about personal finance. I’ll also try to use this newsletter to share more of the behind-the-scenes about me and topics that I otherwise wouldn’t talk about on my YouTube.

📆 Frequency: As always I’ll try to stay consistent with one newsletter per week, but I can’t always guarantee that if my life gets busy or I’m away on holidays!

I’m actually away on a short trip to New Zealand right now, so I’ll make sure to share some photos with you all in next week’s newsletter!

That’s it for this newsletter.

Thanks as always for tuning it and see you around next time hopefully!

🎬 My Recent Videos

Beginners Guide To Investing Into ETFs In Australia - Step-by-step guide on getting started with investing in ETFS

How much house can you actually afford in Australia (by salary) - Ever wondered how much you could afford to buy and rent in Australia based on your salary?

Qatar makes shocking investing into Virgin Australia - Watch about the Qatar investment into Virgin Australia!